Navigating Tax Relief: Comparing Payment Extensions & Reductions in France and India

How L’Association Frehindi Helps Indian Expats Across the EU

Life can throw unexpected hurdles—job loss, family emergencies, or sudden medical bills—that make meeting tax deadlines a challenge. For Indian expats in France and the wider EU, understanding local relief measures is key. Below, we compare how France and India handle payment extensions and reductions, illustrated with real-life scenarios, and explain how L’Association Frehindi, under the patronage of the Indian Embassy in Paris and other Indian missions in Europe, guides you through these processes.

1. Automatic Installments vs Ad Hoc Schemes

| Feature | France | India |

| Automatic Installments | If your annual balance > €300, you’re split into four due dates: Sept 26, Oct 25, Nov 25, Dec 27. | Installment schedules are offered case-by-case; no blanket rule. Taxpayers must apply and justify. |

| Key Benefit | No application needed for balances over threshold. | Flexible, can be tailored to hardship but requires detailed case. |

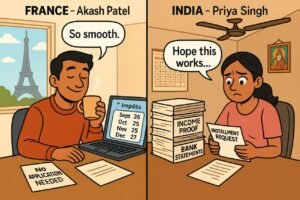

Example (France):

Akash Patel, facing a temporary drop in consultancy income, benefited from the automatic four-part plan—no paperwork, just peace of mind.

Example (India):

Priya Singh had to submit a formal request with income proofs and bank statements to get her installments approved after a company layoff.

2. Requesting More Time to Pay

In France

- Online:

- Log in at impots.gouv.fr → “Messagerie sécurisée” → “J’ai un problème concernant le paiement de mes impôts” → “J’ai des difficultés pour payer.”

- In Person:

- Visit your local Service des Impôts with:

- Form 4805-AP-SD (“questionnaire difficultés de paiement”)

- Latest “avis d’impôt”

- RIB (bank details)

- Proofs of hardship (payslips, rent, bills)

- Visit your local Service des Impôts with:

In India

- File Form No. 12A for “deferment of tax,” attaching:

- Income proof, bank statements

- Explanation of hardship (job loss, medical bills)

- Approval is discretionary and often slow.

Tip from L’Association Frehindi:

Our volunteers can walk you through the French secure messaging portal or assist with printing and filling forms – a free service at our Paris office.

3. Seeking a Tax Reduction (“Remise Gracieuse”)

In France

- Governed by Article R*. 247-1 LPF. Granted only in rare, exceptional cases:

- Unemployment, serious illness, family breakdown

- Debt overwhelming relative to income

- Submit your written request online or to your service des impôts, with the same supporting documents as above plus a clear justification letter.

In India

- Rarely granted, mostly for natural disasters or proven prolonged hardship.

- Submit a “waiver request” to the Commissioner, attaching evidence.

Case Study:

When Rohan Mehta suffered a prolonged illness in Lyon, Frehindi provided a template letter and helped collate medical certificates—ultimately securing a partial waiver of his “taxe foncière.”

4. What Authorities Look At

Both systems evaluate:

- Total household resources: Salaries, social benefits, rental income.

- Essential living expenses: Rent, utilities, food, healthcare.

- Other debts: Over-indebtedness can strengthen your case if genuine.

L’Association Frehindi compiles checklists to ensure your submission covers every necessary detail, speeding up approval.

5. Cash Economy & Black-Money Controls in France

Unlike informal cash transactions common in some regions, France strictly discourages carrying or declaring > €10 000 in cash. Large cash payments can trigger investigations under anti-money-laundering laws. As an expat, always use bank transfers or cheques for tax and rent payments. Our team at Frehindi can advise on safe, compliant payment methods.

6. How L’Association Frehindi Supports You

- Personalized Consultations: In Paris and via video call for those elsewhere in the EU.

- Document Reviews: Ensure your extension or remission requests are complete.

- Templates & Translations: French-language forms and letters, ready to submit.

- Embassy Liaison: Coordinating with the Indian Embassy in Paris and other missions to escalate urgent cases.

Our mission—under the patronage of the Indian Embassy—is to make your stay in Europe smoother, one form at a time.

📌 Final Thoughts

Navigating tax challenges abroad can be daunting—especially when you’re far from home, unfamiliar with the local language, and caught off guard by financial stress. But whether you’re a professional from Mumbai working in Paris, a student from Kathmandu studying in Lille, or a caregiver from Lahore based in Brussels, one truth remains: support systems exist, and you don’t have to face these challenges alone.

While France and the EU offer structured frameworks—like automatic installments, payment deferrals, and even exceptional tax waivers—these processes require timely, well-documented applications. In contrast, India’s approach is less standardized and often discretionary, focusing mainly on interest relief rather than principal tax waivers.

That’s where L’Association Frehindi steps in.

Under the patronage of the Indian Embassy in Paris and supported by Indian missions across the EU, we act as a bridge between complex administrative systems and the Indian and South Asian expat community. Whether it’s helping you fill out Form 4805-AP-SD in French, advising on the safest way to pay your taxes, or even drafting a remission request based on your personal circumstances, we are here to empower you with knowledge and practical help.

✅ Don’t delay. If you’re facing tax-related stress—reach out.

A simple consultation today can save you months of confusion, penalties, or even debt collection tomorrow.

At Frehindi, your challenges are met with action, empathy, and accurate information—because every expat deserves peace of mind in their second home.

📲Let’s Stay in Touch

💬 Join our WhatsApp community for Indian expats in France — a trusted space for real-time questions, support, and shared experiences.

📞 Connect directly at +33 6 27 92 43 98 for personalized guidance.

📘 Like our Facebook page: facebook.com/assofrehindi for daily updates and useful info.

📺 Subscribe to our YouTube channel “Indians in France” for legal, cultural, and lifestyle guidance.

🇮🇳🤝🇫🇷

With Frehindi by your side, navigating life across borders becomes a little easier — and a lot more reassuring.

Warm regards,

Haru Mehra

President,

L’Association Frehindi

A not-for-profit association under French Law 1901

📧 haru@frehindi.com | 🌍 www.frehindi.org | 📞 +33 6 27 92 43 98

Sous le patronage de l'Ambassade de l'Inde à Paris, notre mission est de favoriser l'intégration des jeunes talents et des familles indiennes dans la société française et d'autres pays francophones (पेरिस में भारतीय दूतावास के संरक्षण में, हमारा मिशन भारतीय युवाओं और परिवारों के कौशल को फ्रांस और अन्य फ्रेंच भाषी देशों की समाज में एकीकरण को बढ़ावा देना है ).

Leave a Reply