Banking in France for Indians: Savings & Current Accounts Explained

Settling in France as an Indian—whether as a student, a salaried professional, or an entrepreneur—requires one essential step: opening a bank account. From paying rent to receiving salaries or handling investments, your French bank account will be the foundation of your daily financial life.

This guide explains savings accounts (already popular in France) and current accounts (the one you will most likely need to start with). Real-life examples of Indians in France show how others navigated the system.

Part 1: Savings Accounts in France

French savings accounts are tightly regulated, with interest rates often set by the Banque de France. Many of them are tax-free and designed for residents. Popular types include:

-

Livret A – Open to everyone, tax-free, 1.7% interest in 2025.

-

Livret Jeune – For those aged 12–25, tax-free, also 1.7%.

-

LEP (Livret d’épargne populaire) – For low-income households, 2.7% interest.

-

LDDS (Développement durable et solidaire) – For tax residents, 1.7%.

-

PEL / CEL – Linked to housing loans, fixed rates, minimum yearly deposits required.

-

Bank-offered savings accounts (Livrets d’épargne) – Rates vary, often 0.5%–4%.

💡 Tip for newcomers: Students and new arrivals usually start with a Livret A because it’s simple, tax-free, and available to everyone.

Part 2: Current Accounts in France

A current account (compte courant) is what you need for daily use—salary deposits, rent payments, bills, and online shopping.

Features of a current account in France:

-

IBAN (International Bank Account Number) – Needed for all transactions, including rent.

-

Carte Bancaire (debit card) – Standard Visa/Mastercard linked to your account.

-

Online banking & apps – Most French banks have them, though not always in English.

-

Monthly fees – Typically €2–15 depending on the bank and type of card.

For different profiles:

-

Students – Many banks offer reduced or free fees. Online banks like Revolut are also widely accepted in Europe and are a practical alternative.

-

Salaried professionals – Employers require a French IBAN to pay your salary, so a current account is non-negotiable.

-

Business owners/investors – You will need a professional current account (compte professionnel), which requires more documents (company registration, proof of address, business plan for startups).

Real-Life Experiences

- Shareya Mehrotra (Student, Lyon)

Shareya arrived in Lyon for her Master’s program. She needed a French IBAN quickly to pay her housing deposit. Traditional banks asked for a rental contract and proof of residence, but she didn’t have everything yet.

👉 Solution: She opened a Revolut online account, which gave her a working IBAN within hours. Later, once settled, she opened a Livret A at BNP Paribas to start saving.

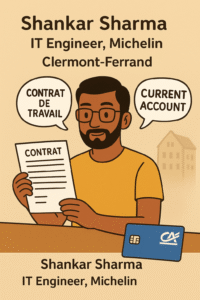

- Shankar Sharma (IT Engineer, Michelin, Clermont-Ferrand)

Shankar came with a work contract at Michelin Tyres. His employer required a French current account for salary transfer. Opening at Crédit Agricole took longer than expected because he didn’t yet have a utility bill in his name.

👉 Solution: He used an attestation d’hébergement (a letter from his landlord confirming his stay) plus his work contract. Within two weeks, his account and debit card were active.

- Raghu Rampalli (Entrepreneur, Nice)

Raghu moved to Nice to start a coffee shop. As a foreign entrepreneur, he had to open a business current account. French banks asked for detailed documents—business registration, proof of investment, and a business plan. Initially frustrated by the paperwork, he worked with a French accountant who helped him prepare the file.

👉 Solution: After initial hiccups, he successfully opened his professional account at Société Générale and linked it with a PEL account to build future credit lines for expansion.

Key Takeaways for Indians in France

-

Students: Start with an online bank like Revolut for speed. Later, open a Livret A for savings.

-

Salaried professionals: Bring your work contract and proof of address. Use an attestation if you don’t yet have bills in your name.

-

Entrepreneurs/investors: Be prepared for paperwork. A professional bank account is mandatory for startups. French accountants and chambers of commerce can help.

India vs France: Banking at a Glance

| Aspect | India | France |

|---|---|---|

| Types of Accounts | Current, Savings, Fixed Deposit | Compte courant (current), Livret A/PEL/CEL/LDDS/LEP (savings) |

| Documents Required | ID proof, PAN, proof of address | Passport, visa/residence permit, proof of address, RIB, birth certificate |

| Opening Timeframe | Same day in most banks | 1–2 weeks (traditional banks), instant with online banks like Revolut |

| IBAN / Account Number | IFSC code for transactions | IBAN required for all payments (salary, rent, bills) |

| Cards Provided | Debit card + optional credit card | Carte Bancaire (debit card), credit card subject to approval |

| Student Accounts | Discounts and student packages | Reduced-fee accounts, Revolut widely used among international students |

| Salary Accounts | Zero-balance salary accounts are common | Employer requires a French IBAN for salary transfer |

| Business Accounts | Simple current account + GST registration for business | Compte professionnel mandatory, detailed paperwork and accountant support |

| Savings Interest | Higher interest rates (3–6% common in India) | Lower regulated rates (1–3% typical in 2025) |

Final Word

Banking in France may feel bureaucratic at first, but with the right approach you’ll quickly have both a current account for daily life and a savings account for financial security.

👉 If you are an Indian student, professional, or entrepreneur preparing to move to France and need step-by-step help with accounts, documents, or financial planning, you can always reach out to L’Association Frehindi at 📧 haru@frehindi.com

We’ll be glad to make your transition smoother.

Team L’Association Frehindi

Stay Connected with Le Frehindi

Stay Connected with Le Frehindi

💬 Confused about French banking? Whether it’s opening your first current account, choosing the right savings option, or navigating paperwork as an Indian in France—our WhatsApp community is here to help. Join today for real-time answers, peer support, and shared experiences.

📞 Need one-on-one guidance? Call or WhatsApp us at +33 6 27 92 43 98 for step-by-step help with documents, IBAN requirements, or business accounts. Join our WhatsApp community — a safe space for real-time answers, peer support, and shared experiences.

📘 Follow our Facebook page: facebook.com/assofrehindi for daily updates, tips, and expat success stories.

📺 Subscribe to our YouTube channel“Indians in France” : Get step-by-step guides on French banking, finance, culture, and legal formalities.

🇮🇳🤝🇫🇷

With Le Frehindi by your side, banking and settling in France becomes easier, smoother, and stress-free.

Warm regards,

Haru Mehra

President,

L’Association Frehindi

Sous le patronage de l'Ambassade de l'Inde à Paris, notre mission est de favoriser l'intégration des jeunes talents et des familles indiennes dans la société française et d'autres pays francophones (पेरिस में भारतीय दूतावास के संरक्षण में, हमारा मिशन भारतीय युवाओं और परिवारों के कौशल को फ्रांस और अन्य फ्रेंच भाषी देशों की समाज में एकीकरण को बढ़ावा देना है ).

Leave a Reply