Carte Vitale in France: What Indian Families Should Know

Moving to France as an Indian family brings many new experiences—some delightful, some puzzling. One of the first systems you will encounter is the French healthcare system, and at the center of it is the Carte Vitale.

This little green card is not just a piece of plastic—it’s the key to getting your medical expenses reimbursed quickly and smoothly. But the way healthcare works in France is quite different from what many of us are used to in India.

What Is the Carte Vitale?

The Carte Vitale is issued once you have your French Social Security Number (SSN). It allows doctors, hospitals, and pharmacies to send your bills directly to the French health insurance agency (CPAM). Once processed, a large part of your expenses—often up to 70%—is automatically reimbursed to your bank account.

The remaining amount is usually covered by a private top-up insurance called a mutuelle. Most French employers provide a mutuelle to their employees and pay at least 50% of the premium. This means that once you have both the Carte Vitale and a mutuelle, nearly all of your medical expenses—from doctor visits to hospital stays—are reimbursed.

A Real-Life Example

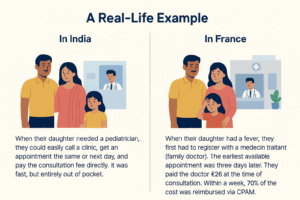

Take the case of Mr. Reddy and his family from Bangalore, who moved to Lyon.

- In India: When their daughter needed a pediatrician, they could easily call a clinic, get an appointment the same or next day, and pay the consultation fee directly. It was fast, but entirely out of pocket.

- In France: When their daughter had a fever, they first had to register with a médecin traitant (family doctor). The earliest available appointment was three days later. They paid the doctor €26 at the time of consultation. Within a week, 70% of the cost was reimbursed via CPAM, and their employer-provided mutuelle covered the remaining 30%.

So while the waiting time was longer, the system ensured their healthcare costs were minimal.

India vs France: What to Expect

- Availability of doctors: In India, there’s a high density of private clinics. Paying directly makes access quick. In France, fewer doctors and high demand mean appointments take longer.

- Payments: In India, you pay everything upfront. In France, you pay first, but most of it comes back automatically if you use your Carte Vitale.

- Insurance: In India, health insurance is optional. In France, everyone is covered by Social Security, and a mutuelle fills the reimbursement gap.

- Patience is required: Efficiency comes with structure—you may wait, but you’re rarely left unprotected from high medical bills.

Cost Comparison: India vs France

- India (private consultation):

- Pediatric consultation: ₹800–1,200 (≈ €10–14)

- Paid fully out of pocket unless privately insured.

- France (general practitioner with Carte Vitale + mutuelle):

- Consultation cost: €26

- CPAM reimburses ~70%: €18.20

- Mutuelle reimburses the rest: €7.80

- Final out-of-pocket expense: €0

So while the upfront fee is higher in France, the combination of Social Security and mutuelle ensures families don’t bear the cost in the long run.

Emergency Services

If you or a family member faces a medical emergency in France, you can call:

- 15 for SAMU (ambulance and urgent medical services)

- 18 for fire brigade (also responds to medical emergencies)

- 112 the Europe-wide emergency number (works from any phone, even without credit)

Step-by-Step: How to Get Your Carte Vitale

- Open a French bank account and secure accommodation (needed for proof of address).

- Apply for a Social Security Number (SSN) at your local CPAM office with documents: passport, residence permit, proof of address, RIB (bank details), and an apostilled birth certificate with French translation.

- Receive a temporary number (NIA) – this already gives you healthcare rights but not a Carte Vitale.

- Wait for your permanent number (NIR/SSN) – usually 3–9 months depending on processing.

- Create your Ameli account once you have the permanent SSN.

- Order your Carte Vitale from Ameli (section Mes démarches > Ma Carte Vitale).

- Update your card once a year at any pharmacy to keep it active.

- Take a mutuelle (through your employer or privately) to cover the remaining 30% of expenses.

Final Word

Adjusting from India’s pay-and-see system to France’s structured-but-slower healthcare can be a cultural shift. But once your Carte Vitale is active and connected with a mutuelle, you will see how the French model ensures long-term affordability and universal access.

If you are an Indian family settling in France and need help with the paperwork or simply want clarity, you can always reach out to L’Association Frehindi at haru@frehindi.com. We’ll be happy to guide you through the process.

Team L’Association Frehindi

✨ Stay Connected with Le Frehindi ✨

💬 Have questions about the Carte Vitale or French healthcare as an Indian family? Join our Join our WhatsApp community — a safe space for real-time answers, peer support, and shared experiences.

📞 Need personal guidance? Call or WhatsApp us at +33 6 27 92 43 98.

📘 Follow our Facebook page: facebook.com/assofrehindi for daily updates and practical tips.

📺 Subscribe to our YouTube channel“Indians in France”for step-by-step guides, cultural insights, and legal advice.

🇮🇳🤝🇫🇷

With Le Frehindi by your side, adapting to life in France — from healthcare to culture — becomes easier, smoother, and stress-free.

Warm regards,

Haru Mehra

President,

L’Association Frehindi

Sous le patronage de l'Ambassade de l'Inde à Paris, notre mission est de favoriser l'intégration des jeunes talents et des familles indiennes dans la société française et d'autres pays francophones (पेरिस में भारतीय दूतावास के संरक्षण में, हमारा मिशन भारतीय युवाओं और परिवारों के कौशल को फ्रांस और अन्य फ्रेंच भाषी देशों की समाज में एकीकरण को बढ़ावा देना है ).

Leave a Reply